These days every penny counts and when you have an opportunity to deduct your expenditures from your yearly income tax, you need to do just that. Some days it might seem as though you work just to pay Uncle Sam. But there are those opportunities that present themselves for you to get at least some of the money you’ve invested in childcare, tools of your trade, or mileage to and from charitable events.

Of course, the rules change practically daily regarding allowable deductions, and, before you take what is, at this point, deemed deductible, you should absolutely double-check with your CPA or tax-advisor. Taking deductions which aren’t valid can result in a whole lot of trouble with the Internal Revenue Service. You can even check with the IRS help desk before taking your deductions.

What Deductions are Available for Dance Classes

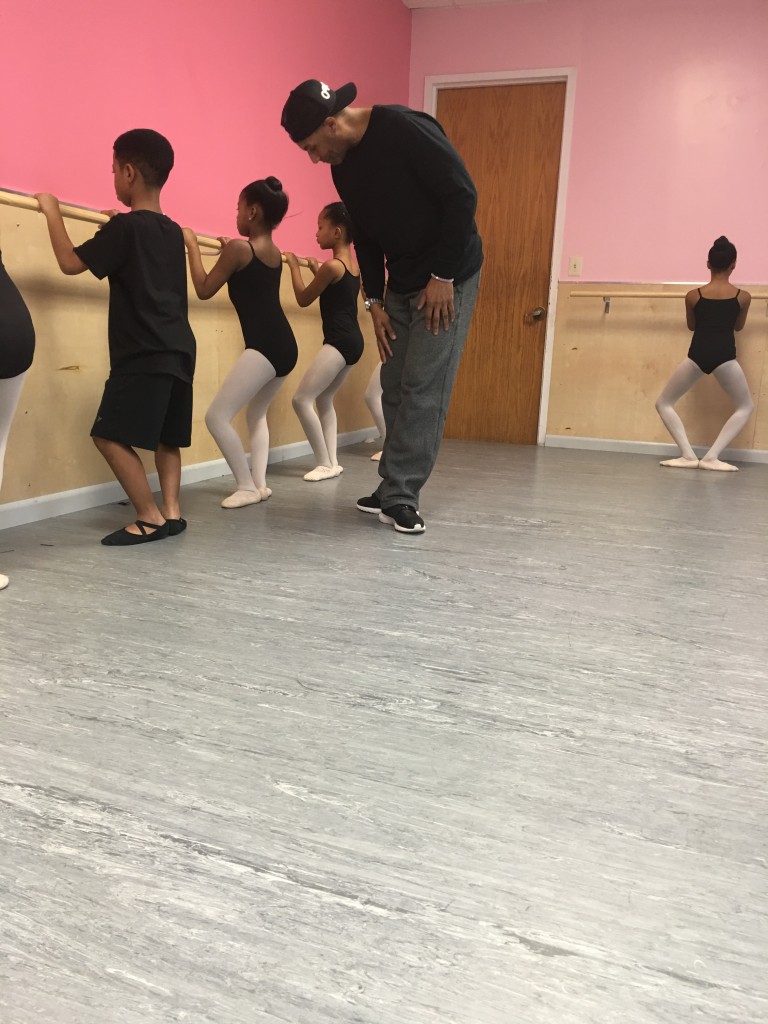

Dance Classes as Childcare – When dance classes are also part of your child’s after school care, they’re deductible as child care with the IRS. And what better opportunity to provide your child with a safe environment, surrounded by caring adults, and given the chance to develop a love of dance? Dance Makers, Inc, also offers formal before and after school care program, keeping kids safe, providing help with homework, offering healthy snack, and meals, and allowing children to develop their creative side through dance.

Sales Tax – If you itemize your deductions, then you already know that sales tax can make a pretty big difference in what the IRS views as your taxable income. The sales tax you pay on shoes, dance clothes, and any materials related to your child’s dance classes may be deductible. Save your receipts.

Donations – Any time your child takes part in a fundraising opportunity to help the community, you may deduct your donations. Dance Makers, Inc. is a 503c non-profit organization with a goal to service children from economically challenged households. Any donations made to Dance Makers, Inc. can be written off.

Dance Income – For those dancers who go on to earn an income, no matter how small, or seemingly inconsequential, you may deduct any expenses related to that paid position.

Of course you want to make sure you’re taking as many advantages as possible when it comes to tax deductions. At Dance Makers, Inc we know you’re committed to your child and will do whatever it takes to help develop his or her healthy interests. For information on our classes, including our before and after school programs, contact Dance Makers, Inc.